/ Return on investment /

I.e. in total 0 € (gross) according to to the project owner’s forecast:

| Year |

0 € |

0 € |

0 € |

0 € |

0 € |

x... your initial investment (i.e. + ... %)

* Tax: Flat tax of 30% on the profit if you declare your income in France. Otherwise, your local tax law applies.

/ Presentation /

Read more

Pitch

PROBLEM & SOLUTIONS

The WedgeInvest Platform responds to an unprecedented capital market situation. Interest rates on each investment today are low or negative. They are determined by the central bank trying to push investors to buy government bonds and overvalued stocks on the public market. Investment in the real economy as for example entrepreneurship and innovation are currently in the second row of current investment strategies.

The private equity market is sanctioned despite the potential it has in value creation and employment. There already is a liquidity allocation problem that we can solve by developing digital tools.

WedgeInvest is the first marketplace to use algorithms to match unlisted companies looking for capital and the most adequate investors. In a few simple steps, WedgeInvest helps its members to raise capital, buy and sell companies, to spot potential investments and new clients and invest in funds dedicated to innovation.

We use personalized and powerful algorithms and a worldwide network of professionals to comply with the need of our members.

WedgeInvest wasn’t conceived nor destined to do meetings for the diverse parties. It is a platform created to boost the number of investment opportunities or private financing expected by each party.

Precise equity evaluation and risk measurement are ads-on. We calculate the fair value of each asset traded offering an independent benchmark for each stakeholder.

How does it work?

We display investment opportunities online by introducing interested members to each other after their mutual consent. Once the enterprise or investor has added an opportunity we look for potential partners.

However, you won’t be able to connect with other members of the WedgeInvest community if you don’t share at least one investment opportunity. In this way, each user can connect with an investor or an offer of his choice.

Each client needs to follow those steps:

- Add an investment opportunity

Each new member is required to express its need in terms of capital, on the assets transaction, and investment portfolios. She/He will be able to choose between merger and acquisitions, financing through the capital, financing of a project, or the acquisition of shares of a proximity or innovation fund.

- Valuation of the opportunity

Our algorithms find for you the best offers and investors corresponding to you in our database of financial transactions and investment mandates in the function of the expressed need.

- Matching of interest

The matching between interests is displayed on the WedgeInvest dashboard. If the transaction or the investor corresponds to the need expressed, the members will connect to go further in the discussions.

- Introduce each other

Once both parties are interested in meeting each other, WedgeInvest will introduce them while respecting their confidentiality. The identity of both parties is shared only if both parties agree.

From this moment each party can use the messaging function to communicate the ones with the others directly and share documents in total confidentiality.

The access to the WedgeInvest platform is free and it is possible to subscribe as a visitor to see the various propositions.

On the basis of multiple subscription plans, it is then possible to benefit from in-depth research and follow-up of our matching algorithms to finally have the opportunity to execute a financial transaction.

The subscription to our matching services is made through monthly plans calculated on a yearly basis. We don’t apply a commission on the transactions made outside the platform.

FUNDRAISING OPERATION

In order to achieve this ambitious project, we wish to raise at least 100 000€ and at most 200 000€ in order to finance the technical development of the WedgeInvest platform. The platform will be launched on the 1st of October 2020.

In return for your investment, you will receive each quarter a share of the revenues of Finwedge for 5 years. The distribution of royalties will start in the first quarter of 2021.

In the scope of our financial plan, we propose a return on investment that will be equal to:

- 2 times the initial amount invested on the basis of a payment of 2,6% of the revenues estimated over 5 years where 1,3% of the revenue is paid to the investor.

-

The raw estimated return for each investor is +108% (x2,08) on 5 years (with a maximum of x 3 if the expected revenue is exceeded)

Your stake will be proportional to your investment

Détails des besoins de financement

| FINANCING | AMOUNT |

| Conception et UX | € 20 000 |

| WebApp MarketPlace | € 30 000 |

| WebApp WedgeInvest | € 100 000 |

| Services & DB | € 30 000 |

| Maintenance & Support | € 20 000 |

| TOTAL | €200 000 |

STRUCTURE

Finwedge is a fintech company founded in April 2019 by a team of entrepreneurs who combine Financial and high-end Technology expertises. The team has an important track record in the growth of technology companies and the creation of trading platforms in several French banks. The WedgeInvest project was labeled by the Pôle Finance Innovation experts at the end of 2019.

In the scope of the promotion of the #femmesentrepreneures, Finwedge has been selected in the 100 companies that applied at the Village by CA at the end of October 2019. The company is part of the 13 companies that have been selected in the accelerator for the beginning of 2020. The company has benefitted from the support of the BPI during the crisis.

Finwedge specializes in the development of SaaS software solutions for the structuration, management of private equity investment portfolios, and the valuation of each enterprise financed by fundraising in investment capital.

Our vision is clear and disruptive. We believe in the positive economy based on the virtuous circle of capital and we think it is important and necessary to make private equity investment transparent in order to orient the available capital in the world towards entrepreneurial projects that have a durable economic impact.

Our main focus is on the scoring and valuation of private equity companies as well as private equity investment portfolios in France and abroad.

Our ambition is to gather the published investment opportunities by enterprises and investment funds in order to match french and international investors in the context of progressive worldwide development.

Positive impacts

WedgeInvest responds to those four missions:

- Make available private equity investments to the international community and capital providers to help the development and growth of entrepreneurship

- Calculate the effective and independent performances for each investment in order to ease the transaction of unlisted shares

- Solve the inability of banks to focus savings in investments helping the financing of innovative startups

- Shorten the circuit of production, management, and distribution of investment funds through greater access to unlisted investment

ECONOMIC IMPACT

WedgeInvest is a market innovation for, on one hand, investment professionals trying to optimize the impact of their method and, on the other hand, private investors constituting their savings. WedgeInvest gives a focused solution, a directly accessible online platform that is interactive and personalized helping investors to choose their investment.

It is important to notice that each investment in a European PME gives a right to a tax deduction of 18%. Private individuals and their asset managers will benefit from free access to information on alternative financial opportunities (capital investment funds or direct capital investment) and in this way will be able to find fiscal optimizations favorable to innovative entrepreneurship.

From the startup’s side, the platform will help fix the reduced value of their activity due to the pandemic. By giving greater visibility of their needs to the financial community of more than 20 000 venture capitalists worldwide. WedgeInvest will give the chance to resilient enterprises to be able to manage the risks of insolubility due to the stop of the activities by identifying new sources of capital.

Thanks to the multiplication of investment opportunities and matching that will be available in October 2020 we will be able to create 10 jobs for June 2021 and train future collaborators to asset valuation that are now students.

Our goal is to constitute our technological headquarters in the Lyon ecosystem and develop our business headquarters in Paris.

Moreover, WedgeInvest will support subscriptions to investment funds in innovation and investment funds of proximity to help regional development.

SOCIAL IMPACT

WedgeInvest will allow:

- Apprentice training coming from Engineering schools and Universities with Economics and Finance classes for an eventual hiring

- Integration of Ph.D. students or PhDs interested in complex system algorithms and machine learning

- Entrepreneurship incentive: new sources of financing for entrepreneurial projects and the development of jobs in startups.

- Large public: greater clarity on alternative financial products usually kept for institutional and private banking clients.

- Savers: the new answer to a need for an investment solution with controlled risk and low cost.

ENVIRONMENTAL IMPACT

Our WedgeInvest platform will allow all users of the platform to diminish the use of paper, mail exchange, and, in a more general way, to be introduced rapidly and directly to reduce the mail exchange and manage the necessary cloud storage.

Moreover, with our asset valorization service, our method of valuing risk related to different types of investment will take into account the ISR requirements as for example environmental, social, and governance.

Lastly, Finwedge favors remote work for its team and video conferences with partners and clients in order to diminish the amount of transportation and energy consumption. We are engaged in sustainable development in our commercial offers and our internal organization in order to diminish the carbon footprint.

Strategy

The WedgeInvest platform offers the easiest and fastest way to access the totality of existing investment opportunities available in the world. It will favor the development of private companies and jobs and value creation.

MARCHÉ, CLIENTS & POSITIONNEMENT

On the unlisted market, we position ourselves as the future trading platform of private enterprises.

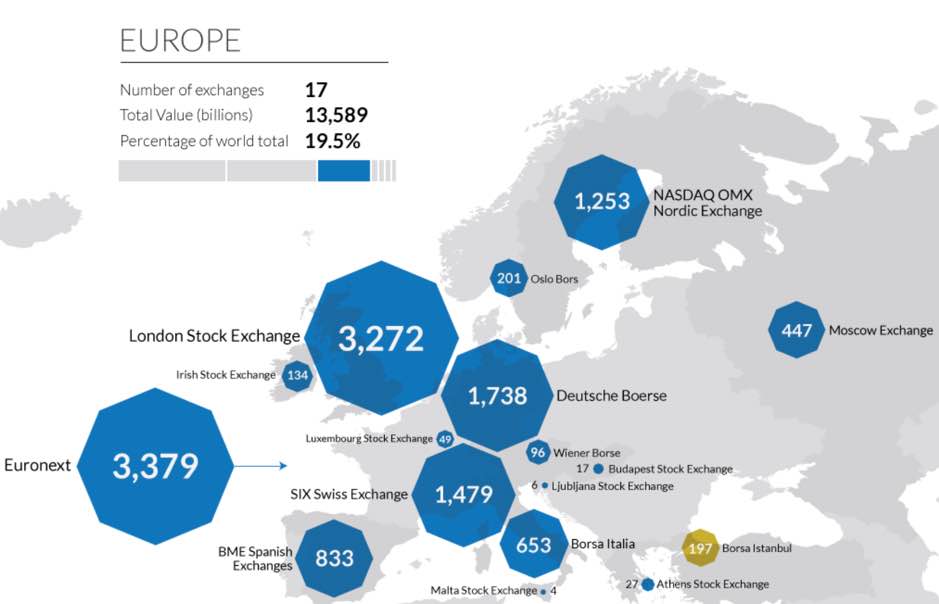

The main stock exchanges are 60 and represent a total value of 69 Billion dollars including 17 European stock exchanges that represent 19.5% of the total value. There is only 16 stock exchange that is part of the “Billion Dollar Club” with more than 1 Billion of Dollars in market capitalization.

This elite group is composed of the most popular stock exchanges, such as the NYSE, Nasdaq, LSE, Deutsche Borse, TMX Group, and Japan Exchange Group, representing 87% of the total value of shares in the world. Together, the 44 other stock exchanges represent only 9 Billion dollars, so, 13% of the market capitalization in the world (data from the World Federation of Exchanges).

Today, the market of private equity worldwide represents in value ten times the stock exchanges and, because the markets evolve rapidly because of technological and regulatory change, the capital-investment funds offer investors the opportunity to access an unusual yield.

Our clients share two compartments of the private equity market. From the “buy-side” there are professional investors, business angels, and non-professional investors that might operate through their asset managers and companies that are looking towards a company to buy. On the “sell-side,” our clients are the companies (pre-money and post-money), the investment funds dedicated to private equity and entrepreneurial venture capital.

Finwedge distinguishes itself from market initiatives such as FFYN by a value proposition where the meeting of the various parties french and international are made on a basis of symmetry of interest and consensus. We do not impose commissions on the operation and/or transactions outside the platform since it is not part of the business model. Only the functionalities of valuation and online transactions that will be developed in the second version of WedgeInvest will be part of negotiation and transaction commissions.

Our ambition is to expand ourselves in proximity markets such as Luxembourg, Ireland, and Switzerland to open the Asian market through Taiwan, Singapore, and Hong-Kong, and the American market through Canada and lastly the United States.

BUSINESS STRATEGY

If you are a company or a professional investor or non-professional investor and you want to appear on WedgeInvest, you will need to pay a monthly subscription from the moment you will communicate your first investment opportunity. Putting in relation and realization of a transaction outside the platform won’t be subject to a commission.

However, as in a classic stock exchange, if you wish to benefit from an independent evaluation of the risk of investment and value the assets that are connected to it, you will need to pay valuation fees and transaction fees for an online negotiation. If you are a financial middleman and you wish to access the various valuations of the list of enterprises, you will need to pay a right to access the data (the activity of trading data outside the stock market).

Each party to our WedgeInvest inserts itself in the ecosystem created by Finwedge. Online, our clients benefit from a dedicated user experience thanks to NLP technology to meet the user’s expectations. This will be supported by the webinars that will be present from September 2020.

Our presence on the private salons such as AMTech in Paris and Patrimonia in Lyon to the broad public will allow us to meet you and offer a personalized experience to exceed your expectations.

RESSOURCES & PARTNERS

The WedgeInvest project is developed by a team of 8 people consisting of experienced professionals in financial trading platforms, private equity, and the creation of SaaS solutions.

The SaaS solution will be hosted on services such as AWS, Azure, or Google Cloud Platform. The developments will be done on standard laptops and deployed on the cloud by a software factory.

WedgeInvest offers a marketplace developed in-house by the Finwedge team of developers and DevOps.

Lastly, we integrate reference data flow, these references are used at different levels of the platform through layers of software integration.

DEVELOPMENT OUTLOOK

The perspective of the evolution of the WedgeInvest platform is global and lie on the use of a technology stack that gathers more than 100 global sources of information dedicated to private equity investment, they range from companies that are in a creative process or those that are in a process of transfer including those furnished by those of our partner, Preqin.

We are today able to put in direct contact with more than 20 000 professional investors with innovative companies that respond to the required criteria by an international financial community.

Our ambition is to become the first marketplace of equity trading and financial instruments dedicated to innovation in order to urge global entrepreneurship in order to face the inefficiency of the current stock exchanges.

Our proposition will open different forms of alternative investment to french and international savers that look for long term investment products giving a superior return on investment compared to traditional products with reduced risk.

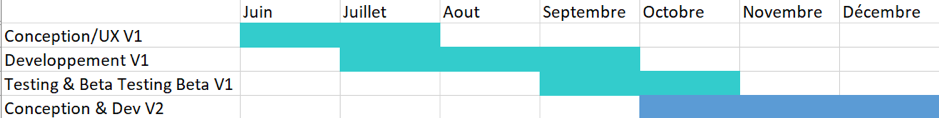

RETROPLANNING

Financial data

Financing mode: investment in royalties

Investment duration: 5 years

Percentage of revenue paid each quarter: 2.6% maximum (for 200 000 Euros raised

Focused profitability: 108% gross on 5 years (risk of loss of the totality of the investment, maximum gain: x3)

Risk: … (evaluated by the users during the evaluation phase )

The company already has a shareholder’s capital of 120 000 Euros.

PROJECT REVENUES

| Years | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

| Estimated revenue | 38 K€ | 1 298 K€ | 3 629 K€ | 5 443 K€ | 6 531 K€ |

Our expected revenues are calculated on the selling of monthly subscriptions for our services on the WedgeInvest platform and your mobile application myWedgeInvest in 2020.

YOUR INVESTMENT

By investing, you subscribe to Finwedge to a return on the revenue of the company proportional to your investment. The total of investors will receive 2.6% of the revenue each year for the fundraising of 200 000 €.

If Finwedge archives the expected returns, the return for each investor will be of 108% gross on 5 years.

What happens if the expected returns aren’t met?

In the case if the expected revenue is not met after 5 years and the company hasn’t closed, Finwedge will continue paying royalties until the full reimbursement of the invested amount.

When do the payments start?

The payments are made on a duration of 5 years from 01/10/2020 and will be paid to each investor each quarter.

Payments of royalties scheduled :

| Date | Month | Year | Payment settled on the revenues of : |

| 15/01/2021 | January | 2021 | October, November, December 2020 |

| 15/04/2021 | April | 2021 | January, February, March 2021 |

| 15/07/2021 | July | 2021 | April, May, June 2021 |

| 15/10/2021 | October | 2021 | July, Aout, September 2021 |

| 15/01/2022 | January | 2022 | October, November, December 2021 |

| 15/04/2022 | April | 2022 | January, February, March 2022 |

| 15/07/2022 | July | 2022 | April, May, June 2022 |

| 15/10/2022 | October | 2022 | Juillet, August, September 2022 |

| 15/01/2023 | January | 2023 | October, November, December 2022 |

| 15/04/2023 | April | 2023 | January, February, March 2023 |

| 15/07/2023 | July | 2023 | April, May, June 2023 |

| 15/10/2023 | October | 2023 | July, August, September 2023 |

| 15/01/2024 | January | 2024 | October, November, December 2023 |

| 15/04/2024 | April | 2024 | January, February, March 2024 |

| 15/07/2024 | July | 2024 | April, May, June 2024 |

| 15/10/2024 | October | 2024 | July, August, September 2024 |

| 15/01/2025 | January | 2025 | October, November, December 2024 |

| 15/04/2025 | April | 2025 | January, February, March 2025 |

| 15/07/2025 | July | 2025 | April, May, June 2025 |

| 15/10/2025 | October | 2025 | July, August, September 2025 |

RISK FACTORS

Warning: those numbers are based on an estimation of our revenue. You can evaluate the project revenue and the strategy to estimate if you will make more or less profit than the announced one. Don’t hesitate to contact us. Your maximum risk is the loss of your investment. In the best scenario, you will obtain the triple of your investment.

Main risks associated to the activity of the project:

– Difficulties to reach a critical mass of matchings and transactions

– The resistance of some stakeholders to comprehend the business model and the correlated interest.

– Non-planned technical management on the platform and cybercriminal attacks and software fraud.

We commit to enliven the ecosystem to make it become as broad as possible by maintaining balanced links between the different parties on the stock market. In this context, we have the problem of the User Experience at the heart of each investment experience while using the most advanced technologies.

Currently, before the current funding offer, the company has sufficient funds to pay its obligations and needs for the next 6 months.

N.B. : with time new risks can arise that can be different from those listed here.

To receive our detailed business plan, contact us at marketing@finwedge.com

Team

Finwedge is today a team of 8 people that are from various nationalities, have a significant amount of women and men with an average of fewer than 30 years old.

Our leader’s team is composed of Delphine (CEO) and Romuald (CTO). Julia (MOA), Delaram (Data scientist), Grigory (Algorithms), Victor (Developer) et Luca (Web APP Mobile) form our operational team.

In Finwedge, our values are goodwill and mutual aid. As a solid team, our mission is the search, day by day, our complementarities and synergies. The positive financial innovation is our passion and we achieve our sprints every day. Every achievement helps each member of the team to better oneself.

Several of us are high-level athletes and others are travelers!

HISTORY

The company was started by Delphine Monti, convinced of WedgeInvest’s success. We believe in the respectful management of our employees, diversity, and multiculturalism. The famous citation of a French author we particularly like illustrates our vision: “If you want to build a boat, you will need to give to your men and women the desire of the sea.”

Among the 100 candidates ‘Le Village by CA Paris’ Finwedge has been selected with 12 other startups at the occasion of a committee dedicated to entrepreneurial women in October 2019.

Our anecdote: Finwedge is the only French fintech to take part in the “FintechTaipei fair” in Taiwan in November 2019.

Statistics

The project evaluation and investment statistics

/ Comments /

Register Connexion