/ Return on investment /

I.e. in total 0 € (gross) according to to the project owner’s forecast:

| Year |

0 € |

0 € |

0 € |

x... your initial investment (i.e. + ... %)

* Tax: Flat tax of 30% on the profit if you declare your income in France. Otherwise, your local tax law applies.

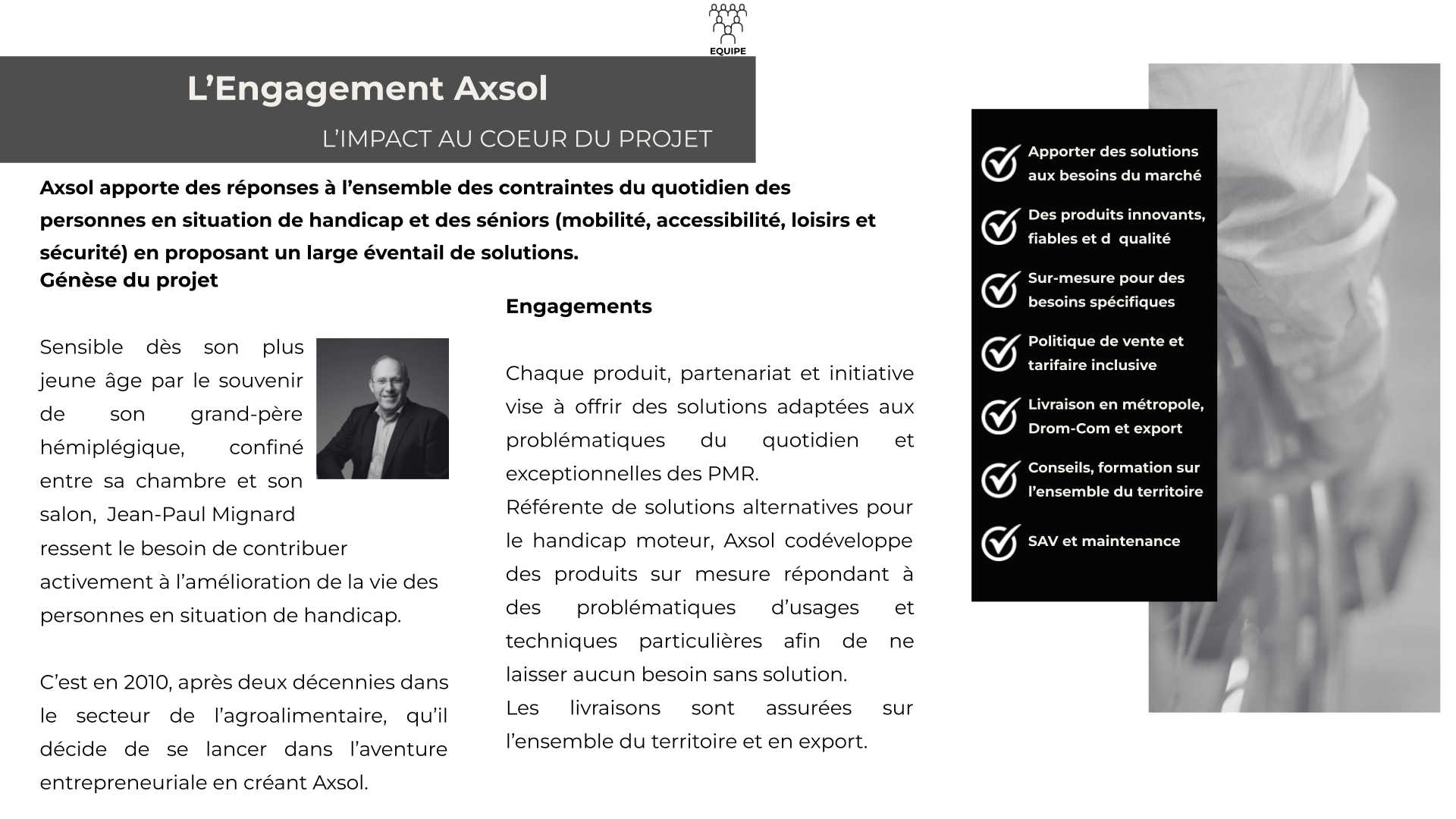

/ Presentation /

Read more

Financial data

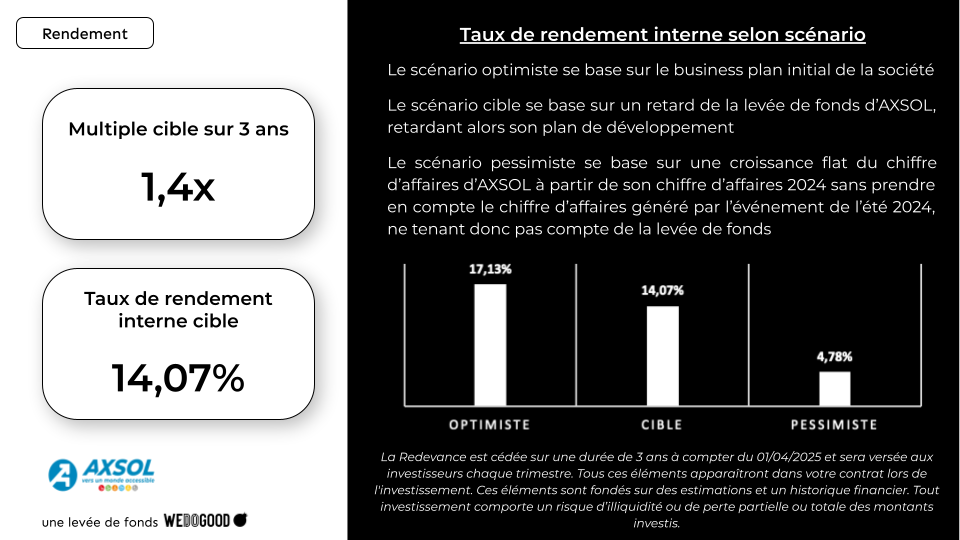

Target profitabilityx1,40 en 3 ans (+40,00 % raw)Risk of full loss of investment, maximum gain: x1,40 Minimum gain as long as the company is in business: x1,15 |

RiskModerate riskrated at 2.72/5 by Internet users during the evaluation phase |

Royalties paid quarterly2,05 % maximum% of turnover paid to all investors, for 173 097,00 € raised, proportional to the amount raised |

Revenues and funding project

We have already gathered 0,00 €

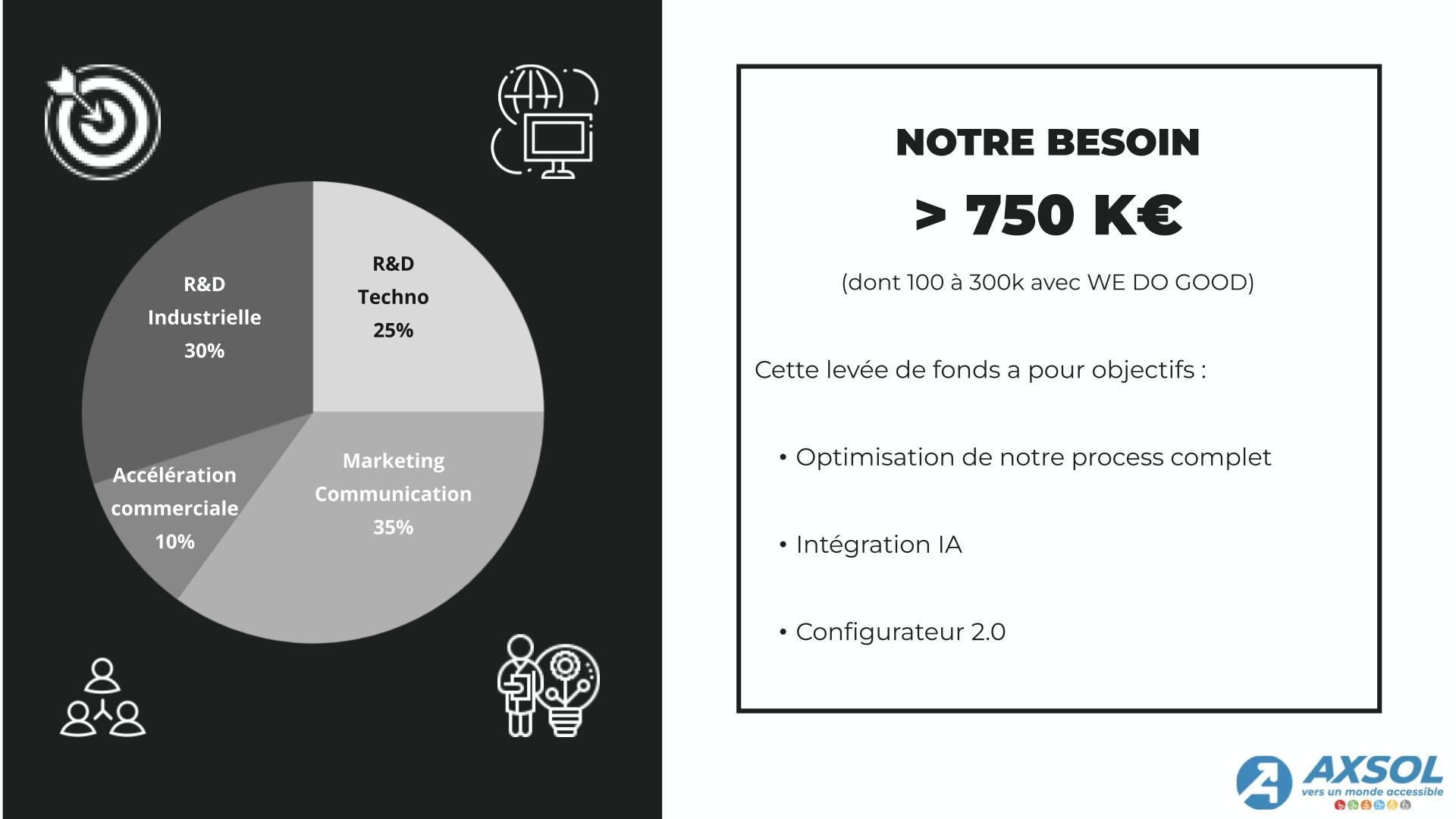

Levée de fonds en cours : 500 k€ auprès de BA

200 k€ engagés par LOI d'un investisseur

Over the 12 months preceding the fundraising, we achieved 2 000 000,00 € in turnover.

AXSOL's fundraisings on WE DO GOOD

Current fundraising - 3 800,00 €

19/03/2025 - 126 903,00 €

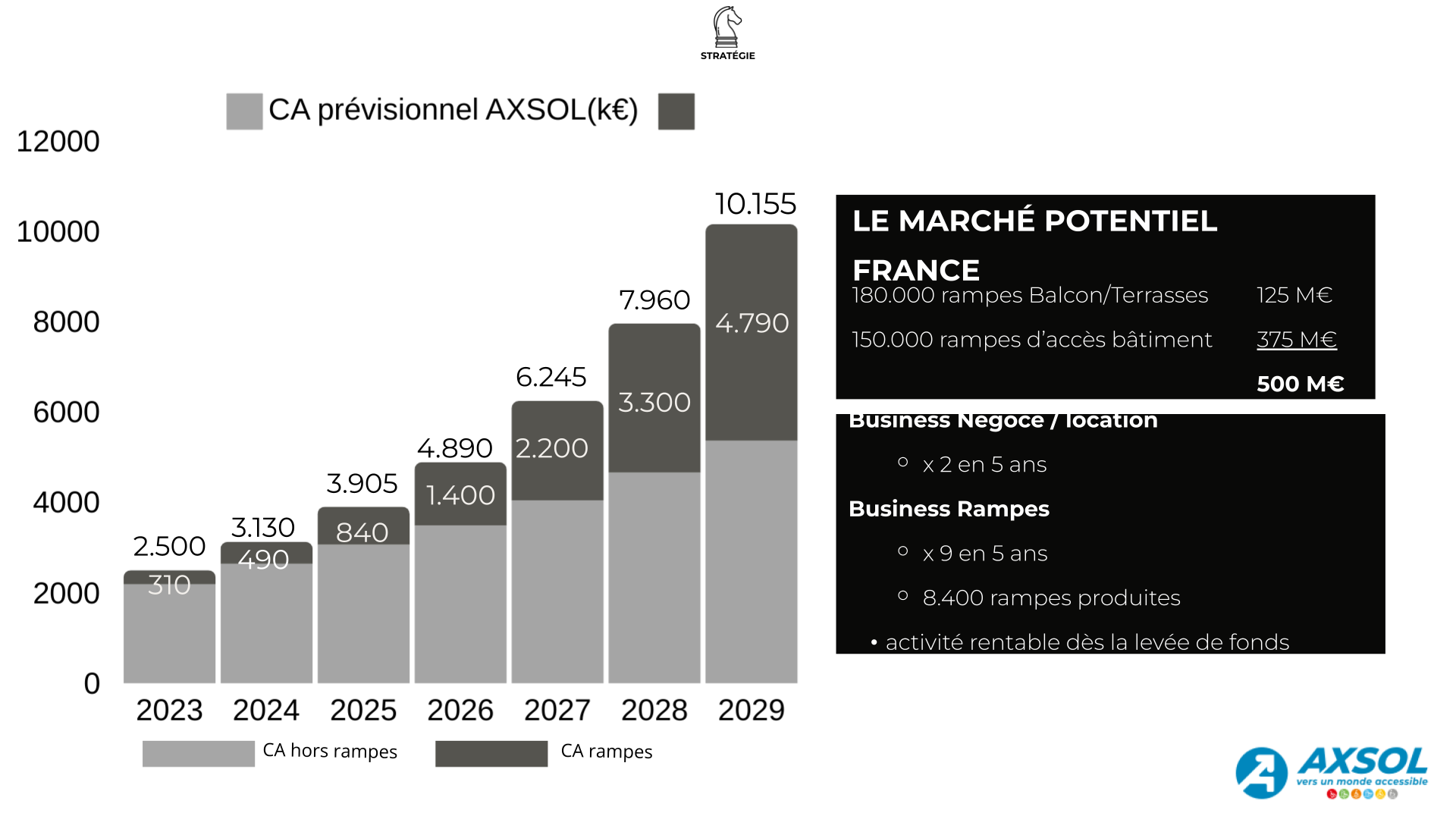

| Year 1 | Year 2 | Year 3 | |

|---|---|---|---|

| Number of sales | 0 | 0 | 0 |

| Projected revenue | 4 900 000,00 € | 6 000 000,00 € | 7 200 000,00 € |

Your investment

By investing, you subscribe to AXSOL for a royalty on the company's turnover, proportional to your investment. The total investors will receive 2,05 % from the turnover achieved each year for a fundraising of 173 097,00 €.

If AXSOL realizes its forecast, the return for each investor will be 40,00 % gross to 3 years.

Calculate my return

What happens if the forecast is not reached?

In the event that the forecast is not reached after 3 years and the activity continues, AXSOL will continue to pay the royalties until a return of 1,15 times the amount invested is reached.

When do payments start?

The Royalty is transferred over a period of 3 years from 01/10/2025 and will be paid to investors on a quarterly basis.

All these elements will appear in your contract during the investment.

Provisional payment schedule

Attention: these figures are based on an estimate of our turnover. It's up to you to evaluate the forecast and the strategy to estimate whether you can expect to earn more or less than the announced annual return.

| Estimated compensation on income of: | Date of payment |

|---|---|

| 2025 | |

| October, November, December | 15/01/2026 |

| 2026 | |

| January, February, March | 15/04/2026 |

| April, May, June | 15/07/2026 |

| July, August, September | 15/10/2026 |

| October, November, December | 15/01/2027 |

| 2027 | |

| January, February, March | 15/04/2027 |

| April, May, June | 15/07/2027 |

| July, August, September | 15/10/2027 |

| October, November, December | 15/01/2028 |

| 2028 | |

| January, February, March | 15/04/2028 |

| April, May, June | 15/07/2028 |

| July, August, September | 15/10/2028 |

Risk factors

Key risk factors related to the activity and project

Risk related to the financial situation of the company

Currently, prior to the completion of the fundraising of this offer, the company Has, with sufficient net working capital to meet its obligations and cash flow needs for the next 6 months.

Sources of funding under consideration in connection with the project presented for the next 6 months:

Activité réccurente car société crée en 2010

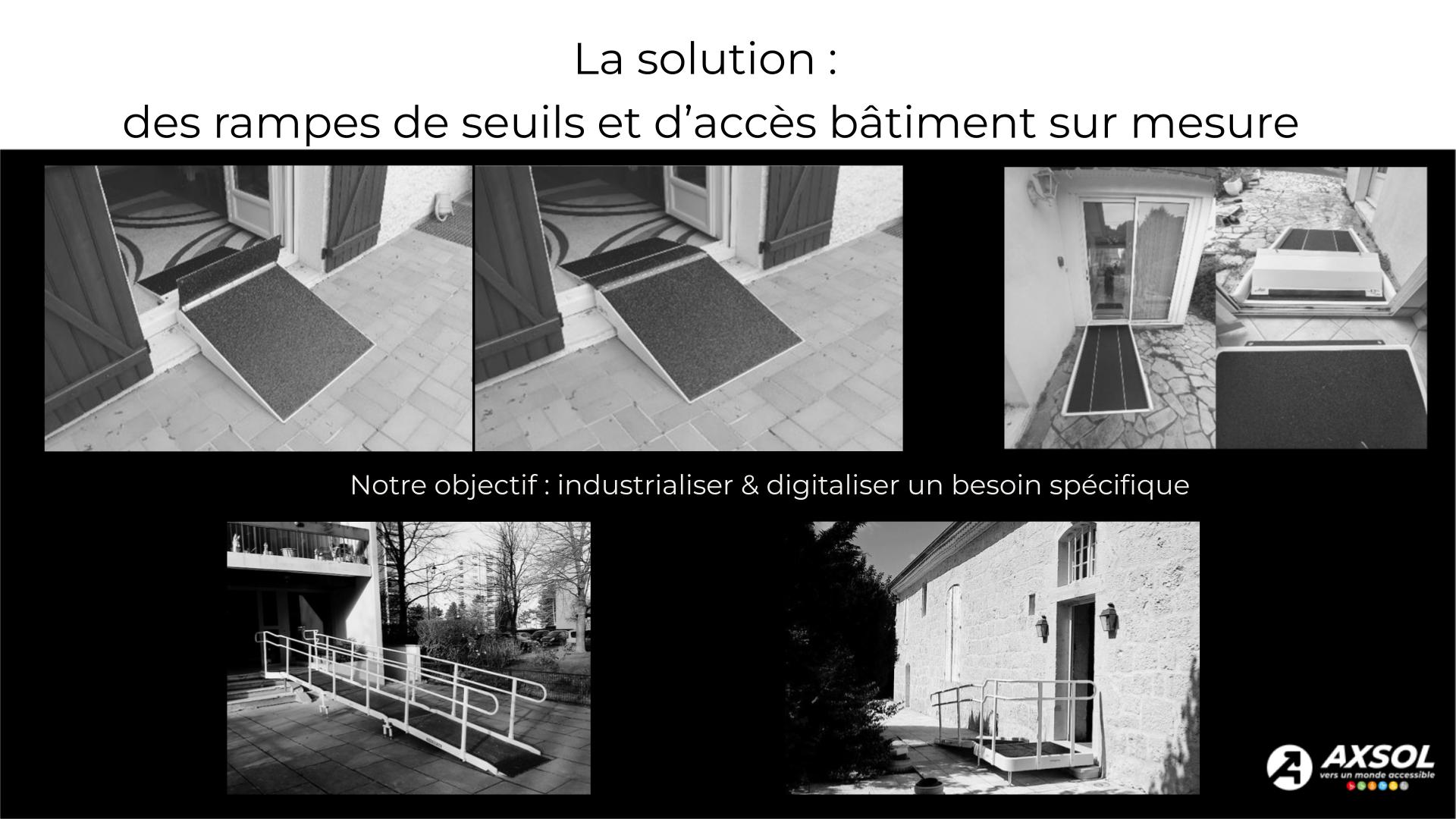

Risque faible. les produits sur mesure ne peuvent être copiés par des fabricants (complexité du sur-mesure, coûts de transport)

No.B.: over time, new risks may emerge and those presented may evolve.

To receive our detailed business plan, contact us at jean-paul.mignard@axsol.fr

Statistics

The project evaluation and investment statistics

/ Comments /

Register Connexion