/ Return on investment /

I.e. in total 0 € (gross) according to to the project owner’s forecast:

| Year |

0 € |

0 € |

0 € |

0 € |

0 € |

x... your initial investment (i.e. + ... %)

* Tax: Flat tax of 30% on the profit if you declare your income in France. Otherwise, your local tax law applies.

/ Presentation /

Read more

Financial data

Target profitabilityx1,49 en 5 ans (+49,40 % raw)Risk of full loss of investment, maximum gain: x3 Minimum gain as long as the company is in business: x1,15 |

RiskModerate riskrated at 2.76/5 by Internet users during the evaluation phase |

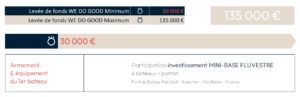

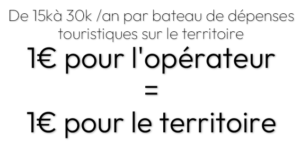

Royalties paid quarterly4,27 % maximum% of turnover paid to all investors, for 104 900,00 € raised, proportional to the amount raised |

Revenues and funding project

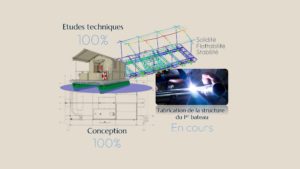

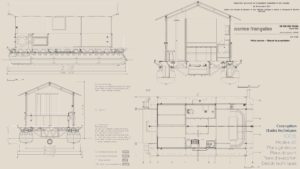

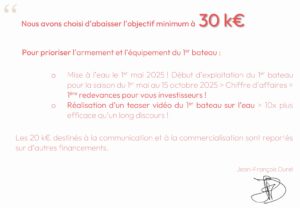

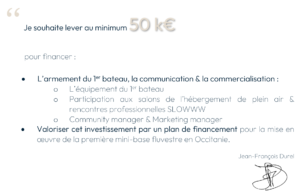

We have already gathered 50 000,00 €

25k€ Aide à la création d'entreprise

25k€ fonds propres

Over the 12 months preceding the fundraising, we achieved 0,00 € in turnover.

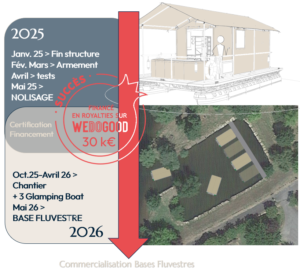

Les coches de Penchot's fundraisings on WE DO GOOD

Current fundraising - 100,00 €

13/01/2025 - 30 100,00 €

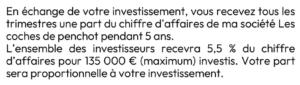

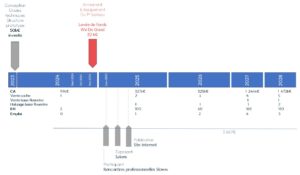

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

|---|---|---|---|---|---|

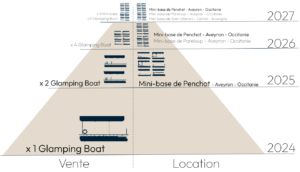

| Number of sales | 1 | 3 | 4 | 9 | 11 |

| Projected revenue | 99 000,00 € | 327 030,00 € | 525 030,00 € | 1 244 030,00 € | 1 472 060,00 € |

Your investment

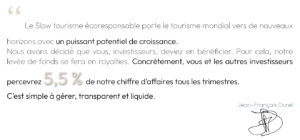

By investing, you subscribe to Les coches de Penchot for a royalty on the company's turnover, proportional to your investment. The total investors will receive 4,27 % from the turnover achieved each year for a fundraising of 104 900,00 €.

If Les coches de Penchot realizes its forecast, the return for each investor will be 49,40 % gross to 5 years.

Calculate my return

What happens if the forecast is not reached?

In the event that the forecast is not reached after 5 years and the activity continues, Les coches de Penchot will continue to pay the royalties until a return of 1,15 times the amount invested is reached.

When do payments start?

The Royalty is transferred over a period of 5 years from 01/07/2025 and will be paid to investors on a quarterly basis.

All these elements will appear in your contract during the investment.

See the standard contract

This contract is a model, it does not serve as a real contract.

Provisional payment schedule

Attention: these figures are based on an estimate of our turnover. It's up to you to evaluate the forecast and the strategy to estimate whether you can expect to earn more or less than the announced annual return.

| Estimated compensation on income of: | Date of payment |

|---|---|

| 2025 | |

| July, August, September | 15/10/2025 |

| October, November, December | 15/01/2026 |

| 2026 | |

| January, February, March | 15/04/2026 |

| April, May, June | 15/07/2026 |

| July, August, September | 15/10/2026 |

| October, November, December | 15/01/2027 |

| 2027 | |

| January, February, March | 15/04/2027 |

| April, May, June | 15/07/2027 |

| July, August, September | 15/10/2027 |

| October, November, December | 15/01/2028 |

| 2028 | |

| January, February, March | 15/04/2028 |

| April, May, June | 15/07/2028 |

| July, August, September | 15/10/2028 |

| October, November, December | 15/01/2029 |

| 2029 | |

| January, February, March | 15/04/2029 |

| April, May, June | 15/07/2029 |

| July, August, September | 15/10/2029 |

| October, November, December | 15/01/2030 |

| 2030 | |

| January, February, March | 15/04/2030 |

| April, May, June | 15/07/2030 |

Risk factors

Key risk factors related to the activity and project

Risk related to the financial situation of the company

Currently, prior to the completion of the fundraising of this offer, the company Has, with sufficient net working capital to meet its obligations and cash flow needs for the next 6 months.

Sources of funding under consideration in connection with the project presented for the next 6 months:

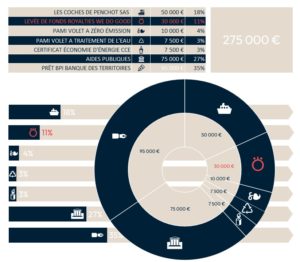

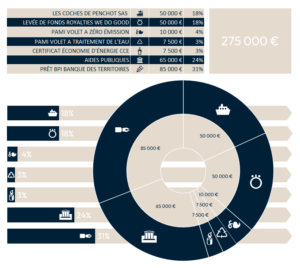

| LES COCHES DE PENCHOT SAS | ⛴ | 50 000 € | 18% | 275 000 € | ||||

| LEVÉE DE FONDS ROYALTIES WE DO GOOD | ⛣ | 50 000 € | 18% | |||||

| PAMI VOLET A ZÉRO ÉMISSION | ❧ | 10 000 € | 4% | |||||

| PAMI VOLET A TRAITEMENT DE L'EAU | ♺ | 7 500 € | 3% | |||||

| CERTIFICAT ÉCONOMIE D'ÉNERGIE CCE | 🕯 | 7 500 € | 3% | |||||

| AIDES PUBLIQUES | 🏛 | 65 000 € | 24% | |||||

| PRÊT BPI BANQUE DES TERRITOIRES | ✒ | 85 000 € | 31% | |||||

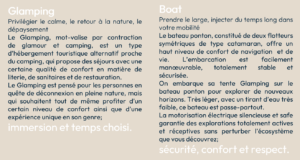

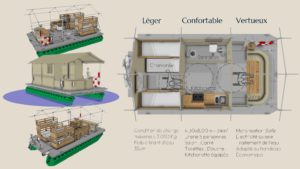

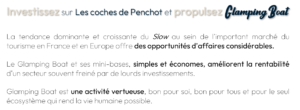

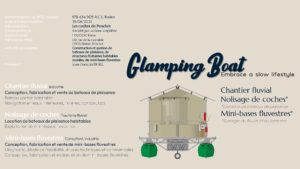

Glamping Boat est un Investissement raisonné basé sur

- Un marché porteur en termes de chiffre d’affaires

- Un investissement corporel

Glamping Boat s'attache à identifier les aléas, leurs risques et de planifier des stratégies pérennes.

Deux aléas identifiés, des stratégies à déployer :

- Associé unique, un risque faible en phase d’amorçage pouvant devenir modéré en phase de croissance

Mon père disait parfois « Les irremplaçables, il y en a plein les cimetières », au sens où, simples mortels que nous sommes, un autre viendra, mais en revanche nôtre poste et ses tâches eux sont intrinsèques à l’activité elle-même. Si je devais me retrouver en incapacité d’assurer mes responsabilités au sein de la société, je pourrais et serais probablement remplacé tout en considérant que ce serait beaucoup plus difficile et incertain s’agissant de l’administrateur fondateur.

> A l’issue de cette phase d’amorçage la recherche d’un.e associé.e fera partie de la stratégie de croissance de la société.

- Pandémie, climat, ressources naturelles, un risque réel mais difficile à évaluer

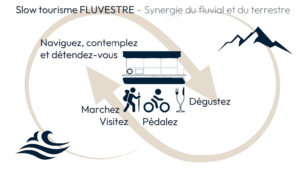

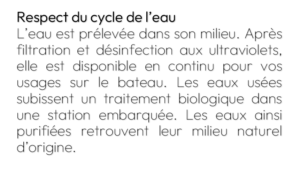

Comme toute activité de tourisme, nous sommes dépendants d’un contexte comme nous l’avons vécu pendant la période de pandémie de 2019 qui a fortement impacté le marché du tourisme. Le changement climatique, ses phénomènes météorologiques extrêmes et la gestion de la ressource en l’eau sont aussi des éléments impactant le tourisme fluvestre.

> Diversifier les activités au-delà du chantier fluvial en s’appuyant sur la capacité de production en matière de soudage de structures en aluminium, pour assurer un niveau d’activités minimal.

> Affecter une part des bénéfices disponibles à un fonds de roulement dédié à la résilience conjoncturelle pour faire face en situation d’aléas sanitaires, climatiques et environnementaux.

‘‘ Dans la vie, il n’y a pas de solutions. Il y a des forces en marche : il faut les créer, et les solutions suivent.

Antoine de Saint-Exupéry, Vol de nuit, 1931

No.B.: over time, new risks may emerge and those presented may evolve.

To receive our detailed business plan, contact us at contact@glampingboat.fr

Statistics

The project evaluation and investment statistics

/ Comments /

Register Connexion