/ Return on investment /

I.e. in total 0 € (gross) according to to the project owner’s forecast:

| Year |

0 € |

0 € |

0 € |

0 € |

0 € |

x... your initial investment (i.e. + ... %)

* Tax: Flat tax of 30% on the profit if you declare your income in France. Otherwise, your local tax law applies.

/ Presentation /

Read more

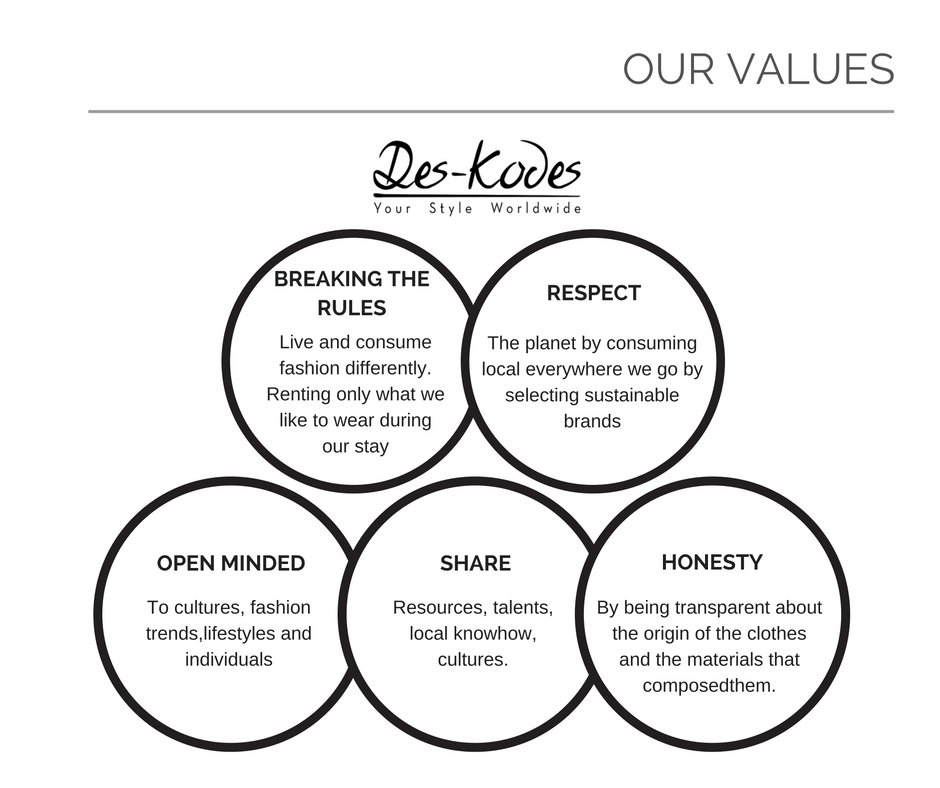

Positive impacts

Des-Kodes is setting up a team of local stylists who are passionate about sustainable fashion, to colla- borate with local brands. Those brands are selected according to sustainable criterias such as local production, using at least 60% of natural materials…

After X seasons the unsold clothes enter our recycling circuit.

Is it possible to make fashion tourism more sustainable ?

The economical and environmental impact of consuming more local is high. Tourism can be one way. We believe it!

Promoting local sustainable brands to tourists visiting Paris, London, New-York and many more cities.

For each destination we propose to clients a selection of sustainable looks picked up by a stylist among local brands’ collections.

The traveller can enjoy the outfits during its stay. If the clients want to buy some of the clothes they like in the suitcase, they can order it at the end of their stay and be delivered at their home address.

The industry today produces too many clothes though the demand is shrinking. Brands a re facing a crisis to find new market opportunities. Des-Kodes is offering one.

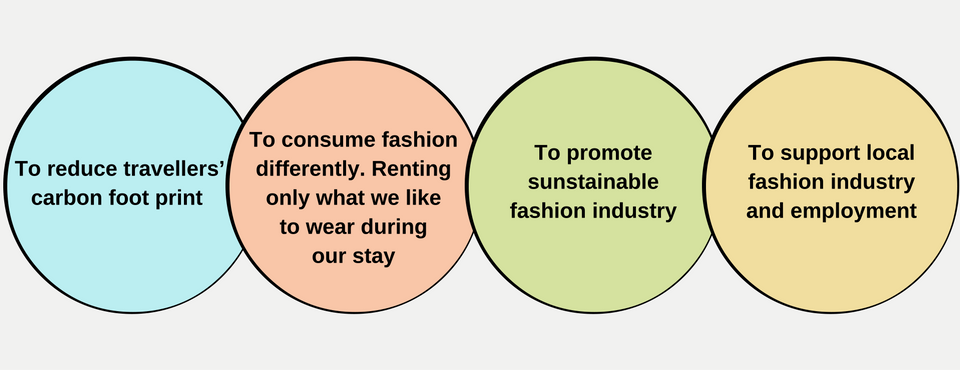

Des-Kodes’ ambition to take up the challenge to change our way of travelling and consuming fashion. By offering to travellers to go away without suitcase, we impact :

Des-Kodes contribute to reduce airlines and travellers foot prints by reducing the weight due to luggages which result to reducing fuel consumption.

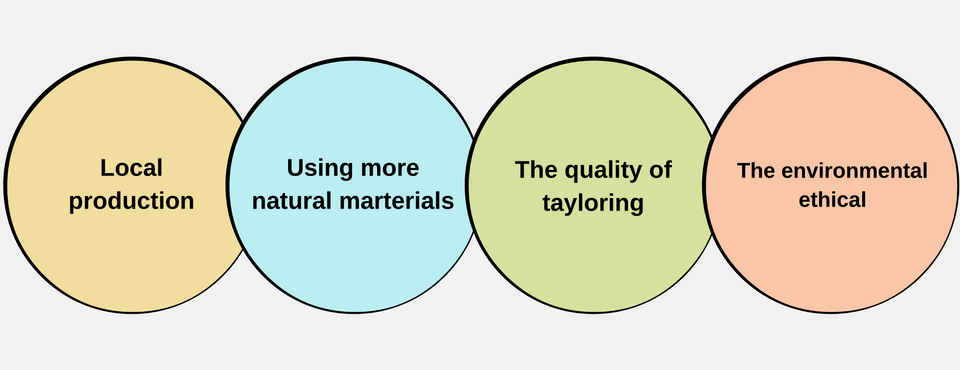

We pay a lot of attention to our partner fashion brands selection. They are selected according to the following ethical and environmental citerias :

> The clothes are selected for being made with at least 60% natural materials. To make a full virtuous circle the clothes which are no longer rented by travellers after x seasons, are sent to recycling factories.

Our dry-cleaning partners are eco-friendly.

> The selected brands and all our logistic are local ( no suitcase travel from a country to another) because we want to promote local brands which produce locally.

> Our packaging : We are looking into developping Des-Kodes sustainable suitcase.

We chose to have a Socially Responsible Economy logostics partner until we develop our logistic platform where we will employ disable people.

Strategy

To complete its innovative idea and irresistible offer Des-Kodes established strategic partnership locally.

After a year and half of testing the idea with travellers. Des-Kodes team is ready to change our way of travelling and to consume fashion.

The economical and environmental impact of consuming more local is high. Tourism can be one way, we are convinced that promoting local creative and production will make a difference.

We want tourists visiting Paris, New-York or London by experimenting locals fashion brands the same way they can experiment culture or food…

« We want travellers to visit Paris, New-York, London… by experimenting local fashion brands the same way they can experiment culture, food… »

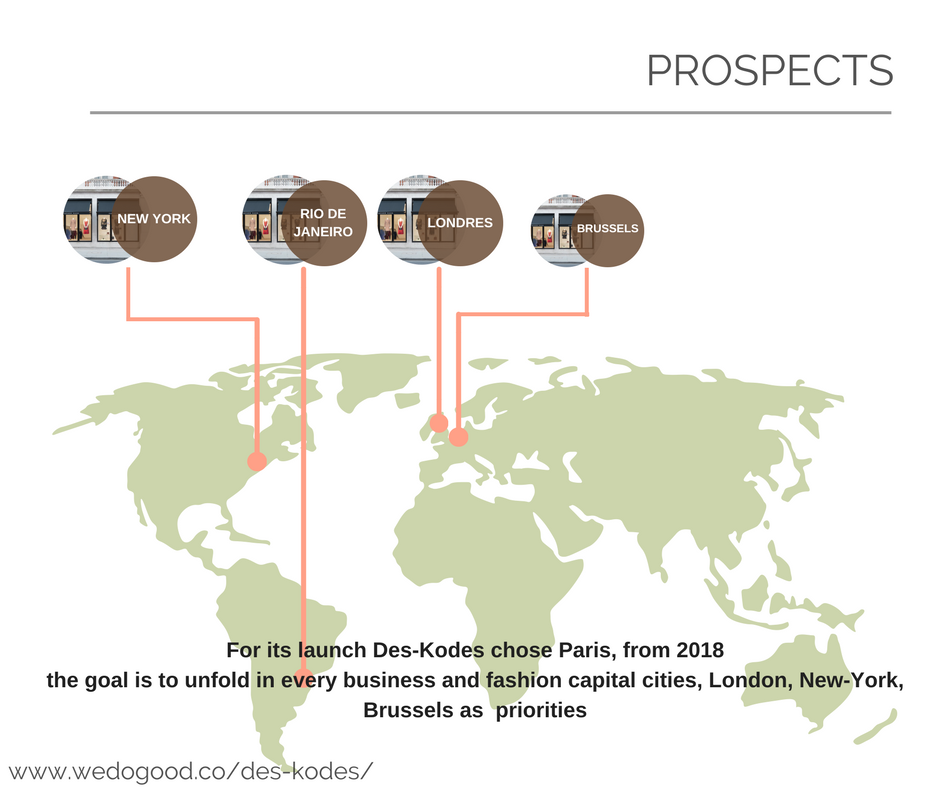

For its launch Des-Kodes chose the world capital of fashion and tourism: Paris.

Parisians’ «effortless» elegance that fashionistas around the world dream about..

__________________________________________________

MARKET :

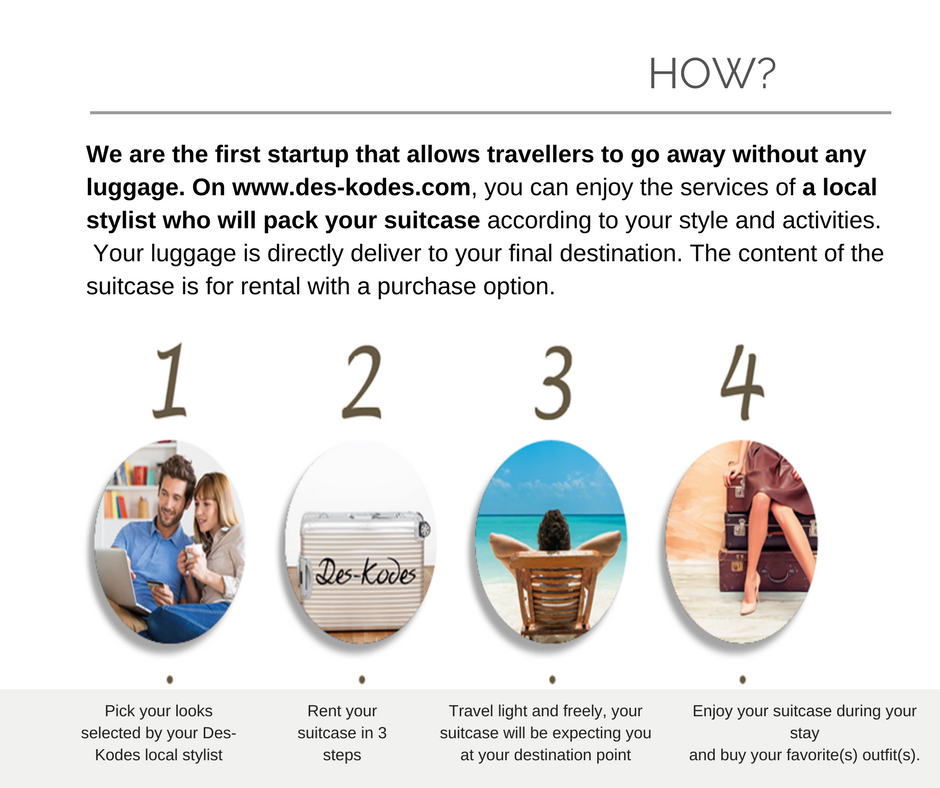

Des-Kodes, is a travel startup which tooks up the challenge to change our way of travelling and consuming fashion. How? By offering to travellers to go away without suitcase. By providing local stylists to set up the suitcase. The content is for rent and the suitcases are directly deliver to the travellers’ destination point (hotel, rental home…).

The travellers only have to go on Des-Kodes’ website www.des-kodes.com to select the looks they want according to their activities during their stay and their personal style.

Our target are men and women, locals and foreigners tourist. So our market is ready to wear for men and women and tourism.

Ready to wear Market

TRENDS |

Volume sales of menswear increased by 1% in 2015, a superior performance to the marginally negative volume CAGR recorded in the category over the review period. The improved economic context and favourable weather conditions again had a positive impact on sales of the spring/summer and autumn/winter menswear collections. However, the category still recorded a marginal current value decline in 2015 as the average unit price in the category remained on a downwards trend. Value sales of menswear continued to be negatively affected by the success of low-priced brands, notably Primark, as well as additional promotional activities such as private sales being undertaken at retail level. Many French men have taken full advantage of such promotions and they are buying less of their clothing outside of the major sales periods. Men are also purchasing more of their apparel online. The constant search for price discounts and bargains is thus strengthening.

COMPETITIVE LANDSCAPE |

Menswear in France is a fragmented category with more than 70 players operating in it. Marc Laurent SA led the category in 2015 with its Celio brand, followed by H&M Hennes & Mauritz Sarl and Happychic Group, featureless companies registering a value share of 5%. KIABI Europe SAS followed in fourth position with a 3% value share. Each of these companies has developed a vertical integration strategy and they all offer wide ranges of items for men of all ages in their company-owned stores.

PROSPECTS |

The improved prospects for the economic situation in France are set to lead increasing numbers of French consumers to pay less attention to the amount of money they are spending on menswear. Physical appearance is becoming increasingly important among men and more of them are becoming increasingly receptive to fashion trends. Thus, the category is expected to recover in volume terms over the forecast period. ( Source Euromonitor)

According to IFM (French Fashion Institute)Tourism represent a growth opportunity for the Ready to wear market. Especialy for Women Ready to wear market.

(Source XERFI).

Travel market in France :

The terrorist attacks in Paris were not sufficient to spoil the party: the country saw an increase to 84 million arrivals in 2015. Other than the favourable weather, its wide cultural heritage, gastronomy, varied and appealing landscapes and key tourist attractions continued to attract inbound tourists. Sales in car rental saw a better performance in 2015 than in 2014. However, hotel room nights were cannibalised by short-term rentals and campsites, limiting growth, and the decline in value sales of intermediaries continued.

TRENDS |

- Convenience is king with consumers choosing bag-free,hassle free travel and ‘clicks & mortar’ agencies that blend the best of the online and offline worlds.

- Global economic outlook remains uncertain with most developed economies showing sluggish growth and emerging economies struggling to maintain higher advances.

- Increased terrorism threats ,US Presidential elections and the Brexit aftermath are all causing uncertainty across the globe and impacting economic growth and stability.

- Nonetheless, tourism arrivals are extremely resilient with 2016 predicted to be another record year for inbound trips, with 2015 seeing more than 1.2 billion worldwide.

- Travel product sales were US$ 2.1trillion in 2015 and are expected to top US$ 2.5trillion by 2020 ,boosted by the adoption of new technology and diverse business models.

- Domestic trips are also performing well, with more than nine billion in 2015 and a strong growth rate of 6.1% as consumers enjoy exploring their home nations, often as a first ever trip.

- Inbound receipts saw excellent growth in 2015 to reach more than US$ 1.6 billion, with Asia Pacific being the region driving this expansion intourism spending.

- Online and mobile travel continues to expand across the globe, helped by growing consumer confidence in emerging regions for mobile payments.

- However, the majority of mobile travel purchases are stealing share from other online methods such as PCs, offline is still predicted to have higher global value than online in 2020.

CUSTOMERS :

Our early adopters are women working at an executive level or entrepreneurs, travelling for work, for short trips. But we want to reach to men and women aged between 25 and 55 years old, connected, mobile, senior excutive and open minded.

COMMERCIAL STARTEGY :

Strong partnerships to reach out to our audience :

- Commercial partnerships with tourism actors

- Co-branding with influecial blogs and personalities sharing our values.

- Fashion and tourism magazines, newspaper

- Social network

- Partnership with brands…

RESSOURCE AND PARTNERS :

Paris, the capital of fashion and tourism city is our first destination. We already have 8 french brands as partners. Brands such as Cacharel, Amandine Leforestier, L’Herbe Rouge… and also we have partners in the tourism sector.

______________________________________________

As soon as possible Des-Kodes will start its international development, we already have a local tourist working in Bresil. Our goal is to deploy Des-Kodes in all business and fashion cities like London, New-York, Sao Paulo, Brussels…

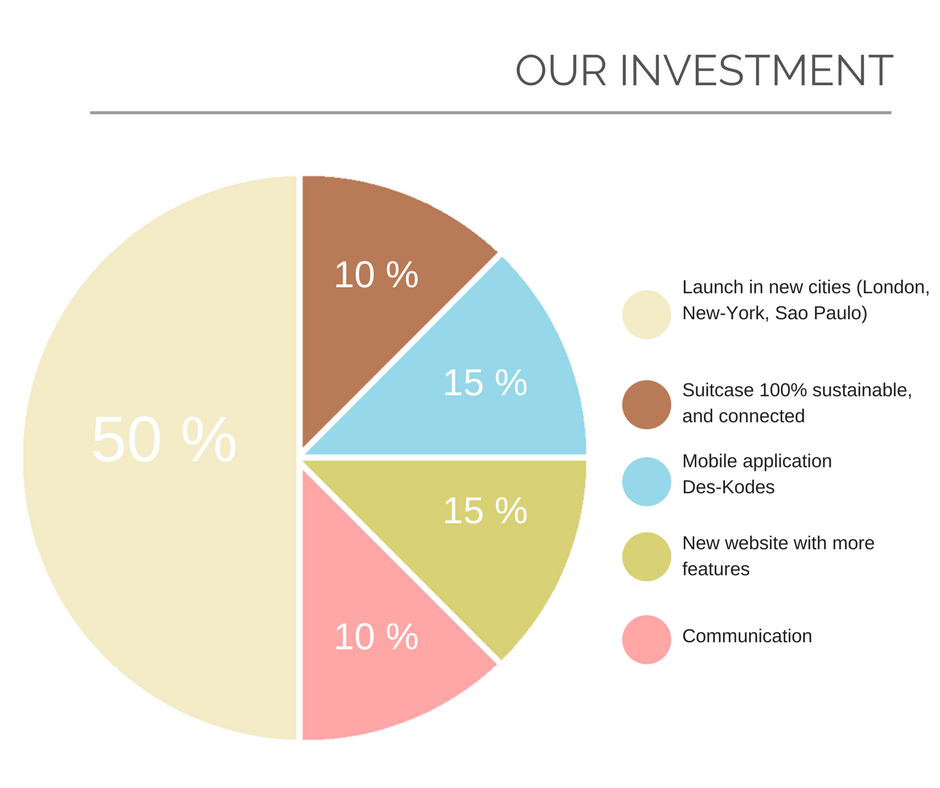

Financial data

______________________________________________

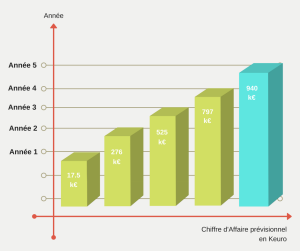

FORECAST

______________________________________________

YOUR ROI

Tableau prévisionnel des versements :

| Date | Rémunération estimée sur les revenus de : |

| 10/07/2016 | Avril, mai, juin 2017 |

| 10/10/2016 | Juillet, août, septembre 2017 |

| … | … |

| 10/01/2020 | Octobre, novembre, décembre 2021 |

| 10/04/2022 | Janvier, février, mars 2022 |

Attention : ces chiffres se basent sur une estimation de notre chiffre d’affaires. A vous d’évaluer le prévisionnel et la stratégie pour estimer si vous pouvez espérer gagner plus ou moins que le rendement annuel annoncé. Votre risque maximum est la perte intégrale de votre investissement, et vous retrouvez au mieux le double de votre investissement.

______________________________________________

DK corp est une SASU au capital social de 7500€ détenue à 100% par Isna Kimbembe.

Investissement des associés en compte courant 33000€

______________________________________________

FACTEURS DE RISQUE

Principaux facteurs de risque liés à l’activité et au projet :

- Risques liés à l’innovation à l’usage: Mais nous adressons ce risque en apportant un service pratique qui permettra, à travers le voyage de rassurer et d’amèner les prospects au changement dans les usages.

- Risque liés à l’orchestration logistique : mais nous avons prévu le tissu de partenaire pertinent pour mutualiser toute la chainte logistique (Stuart, Europcar)

- Risque sur les tailles : prise en compte dans le partenariat avec Fitizzy qui permet en rentrant une seule fois ses mesures de dire quelle taille dans quelle marque ?

Statistics

The project evaluation and investment statistics

/ Comments /

Register Connexion