/ Return on investment /

I.e. in total 0 € (gross) according to to the project owner’s forecast:

| Year |

0 € |

0 € |

0 € |

0 € |

0 € |

x... your initial investment (i.e. + ... %)

* Tax: Flat tax of 30% on the profit if you declare your income in France. Otherwise, your local tax law applies.

/ Presentation /

Read more

Financial data

Target profitabilityx3,00 en 5 ans (+200,00 % raw)Risk of full loss of investment, maximum gain: x3 Minimum gain as long as the company is in business: x1,15 |

Royalties paid quarterly3,00 % maximum% of turnover paid to all investors, for 100 000,00 € raised, proportional to the amount raised |

Revenues and funding project

We have already gathered 7 000,00 €

Nous avons à date réalisé 7000 euros de CA et avons en cours plus de 35 000 euros de devis.

Over the 12 months preceding the fundraising, we achieved 0,00 € in turnover.

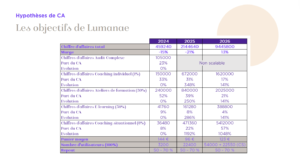

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

|---|---|---|---|---|---|

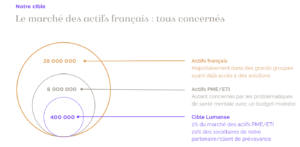

| Number of sales | 20 | 50 | 100 | 120 | 140 |

| Projected revenue | 460 000,00 € | 2 150 000,00 € | 9 450 000,00 € | 10 000 000,00 € | 12 000 000,00 € |

Your investment

By investing, you subscribe to LUMANAE for a royalty on the company's turnover, proportional to your investment. The total investors will receive 3,00 % from the turnover achieved each year for a fundraising of 100 000,00 €.

If LUMANAE realizes its forecast, the return for each investor will be 200,00 % gross to 5 years.

Calculate my return

What happens if the forecast is not reached?

In the event that the forecast is not reached after 5 years and the activity continues, LUMANAE will continue to pay the royalties until a return of 1,15 times the amount invested is reached.

When do payments start?

The Royalty is transferred over a period of 5 years from 01/10/2024 and will be paid to investors on a quarterly basis.

All these elements will appear in your contract during the investment.

Provisional payment schedule

Attention: these figures are based on an estimate of our turnover. It's up to you to evaluate the forecast and the strategy to estimate whether you can expect to earn more or less than the announced annual return.

| Estimated compensation on income of: | Date of payment |

|---|---|

| 2024 | |

| October, November, December | 15/01/2025 |

| 2025 | |

| January, February, March | 15/04/2025 |

| April, May, June | 15/07/2025 |

| July, August, September | 15/10/2025 |

| October, November, December | 15/01/2026 |

| 2026 | |

| January, February, March | 15/04/2026 |

| April, May, June | 15/07/2026 |

| July, August, September | 15/10/2026 |

| October, November, December | 15/01/2027 |

| 2027 | |

| January, February, March | 15/04/2027 |

| April, May, June | 15/07/2027 |

| July, August, September | 15/10/2027 |

| October, November, December | 15/01/2028 |

| 2028 | |

| January, February, March | 15/04/2028 |

| April, May, June | 15/07/2028 |

| July, August, September | 15/10/2028 |

| October, November, December | 15/01/2029 |

| 2029 | |

| January, February, March | 15/04/2029 |

| April, May, June | 15/07/2029 |

| July, August, September | 15/10/2029 |

Risk factors

Key risk factors related to the activity and project

Risk related to the financial situation of the company

Currently, prior to the completion of the fundraising of this offer, the company does not have, with sufficient net working capital to meet its obligations and cash flow needs for the next 6 months.

Sources of funding under consideration in connection with the project presented for the next 6 months:

Nous envisageons les financements suivants dans les 6 prochains mois :

- Avril 2024 : intégration de l'incubateur Willa pour candidater à l’obtention de la subvention FPI de la BPI (en attente de retour de la BPI) .

- Eté 2024 : lancement des démarches pour obtenir un emprunt bancaire afin de pouvoir recruter rapidement notre équipe.

En parallèle, nous commençons à générer nos premiers euros de chiffre d'affaires, avec un CA à date de 7000 euros HT et des devis en cours pour un montant de 35 000 euros HT que nous espérons pouvoir closer avant le mois de Juin 2024.

Notre objectif, étant de générer le plus rapidement du chiffre d'affaires pour développer la société.

Nous avons identifié notamment 3 facteurs de risques potentiels :

1 : Stabilité économique de Lumanae en 2025, si recrutements trop importants - pour le contrer, nous privilégierons une gestion en bon père de famille avec priorisation des freelances plutôt que des CDI pour plus de flexibilité.

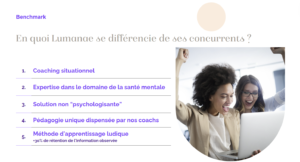

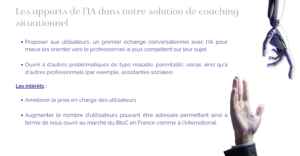

2: La concurrence pourrait vouloir copier notre solution de coaching situationnel, cependant, même si c'était le cas, notre approche hybride à 360, entre le sur-mesure et la solution digitale, correspondant parfaitement aux besoins des PME/ETI, très peu adressées sur notre marché, nous laisse à penser que le risque est maitrisé car notre proposition de valeur est plus large.

3: Application digitale non efficiente, c'est pourquoi, nous cherchons à lever des fonds afin de pouvoir faire appel aux meilleurs partenaires pour développer une application solide qui satisfera aux besoins de nos utilisateurs, avec une ergonomie adaptée et une réactivité sans faille.

No.B.: over time, new risks may emerge and those presented may evolve.

To receive our detailed business plan, contact us at contact@lumanae.com

/ Comments /

Register Connexion