/ Return on investment /

I.e. in total 0 € (gross) according to to the project owner’s forecast:

| Year |

0 € |

0 € |

0 € |

0 € |

0 € |

x... your initial investment (i.e. + ... %)

* Tax: Flat tax of 30% on the profit if you declare your income in France. Otherwise, your local tax law applies.

/ Presentation /

Read more

Financial data

Target profitabilityx1,33 en 5 ans (+32,55 % raw)Risk of full loss of investment, maximum gain: x3 Minimum gain as long as the company is in business: x1,15 |

RiskModerate riskrated at 2.71/5 by Internet users during the evaluation phase |

Royalties paid quarterly1,20 % maximum% of turnover paid to all investors, for 50 000,00 € raised, proportional to the amount raised |

Revenues and funding project

We have already gathered 108 000,00 €

Apport personnel et prêts bancaires

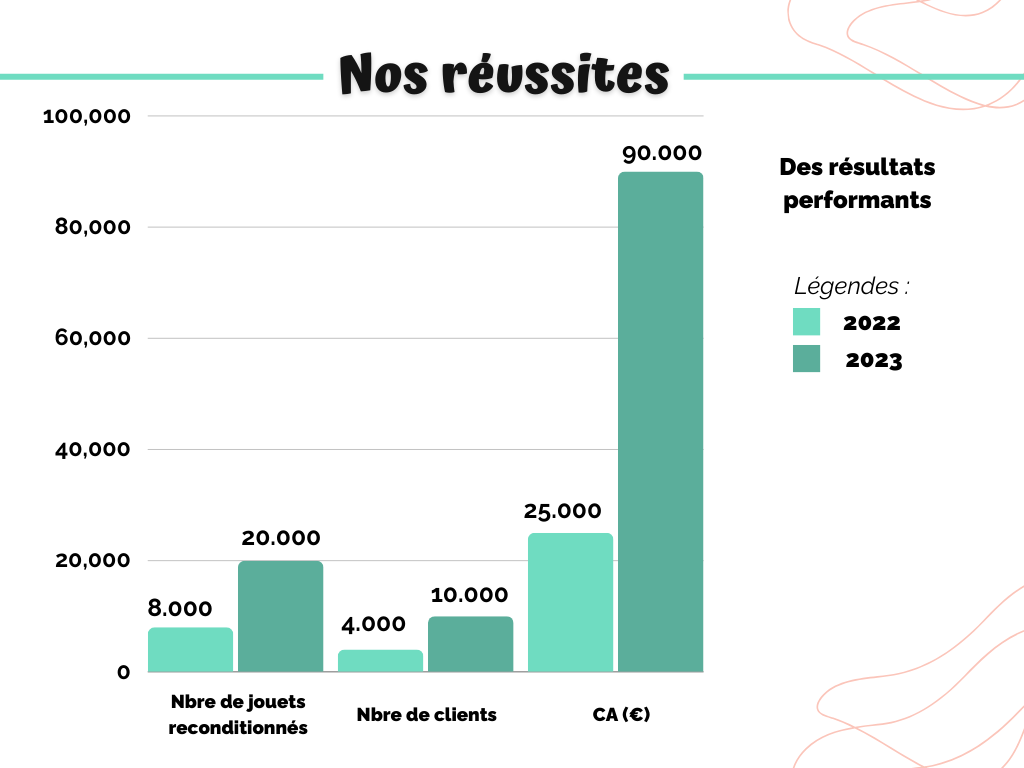

Over the 12 months preceding the fundraising, we achieved 100 000,00 € in turnover.

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

|---|---|---|---|---|---|

| Number of sales | N/A | N/A | N/A | N/A | N/A |

| Projected revenue | 268 000,00 € | 615 000,00 € | 1 100 000,00 € | 1 640 000,00 € | 1 900 000,00 € |

Your investment

By investing, you subscribe to lady cocotte for a royalty on the company's turnover, proportional to your investment. The total investors will receive 1,20 % from the turnover achieved each year for a fundraising of 50 000,00 €.

If lady cocotte realizes its forecast, the return for each investor will be 32,55 % gross to 5 years.

Calculate my return

What happens if the forecast is not reached?

In the event that the forecast is not reached after 5 years and the activity continues, lady cocotte will continue to pay the royalties until a return of 1,15 times the amount invested is reached.

When do payments start?

The Royalty is transferred over a period of 5 years from 01/07/2024 and will be paid to investors on a quarterly basis.

All these elements will appear in your contract during the investment.

See the standard contract

This contract is a model, it does not serve as a real contract.

Provisional payment schedule

Attention: these figures are based on an estimate of our turnover. It's up to you to evaluate the forecast and the strategy to estimate whether you can expect to earn more or less than the announced annual return.

| Estimated compensation on income of: | Date of payment |

|---|---|

| 2024 | |

| July, August, September | 15/10/2024 |

| October, November, December | 15/01/2025 |

| 2025 | |

| January, February, March | 15/04/2025 |

| April, May, June | 15/07/2025 |

| July, August, September | 15/10/2025 |

| October, November, December | 15/01/2026 |

| 2026 | |

| January, February, March | 15/04/2026 |

| April, May, June | 15/07/2026 |

| July, August, September | 15/10/2026 |

| October, November, December | 15/01/2027 |

| 2027 | |

| January, February, March | 15/04/2027 |

| April, May, June | 15/07/2027 |

| July, August, September | 15/10/2027 |

| October, November, December | 15/01/2028 |

| 2028 | |

| January, February, March | 15/04/2028 |

| April, May, June | 15/07/2028 |

| July, August, September | 15/10/2028 |

| October, November, December | 15/01/2029 |

| 2029 | |

| January, February, March | 15/04/2029 |

| April, May, June | 15/07/2029 |

Risk factors

Key risk factors related to the activity and project

Risk related to the financial situation of the company

Currently, prior to the completion of the fundraising of this offer, the company Has, with sufficient net working capital to meet its obligations and cash flow needs for the next 6 months.

Sources of funding under consideration in connection with the project presented for the next 6 months:

Prêt bancaires et apport personnel

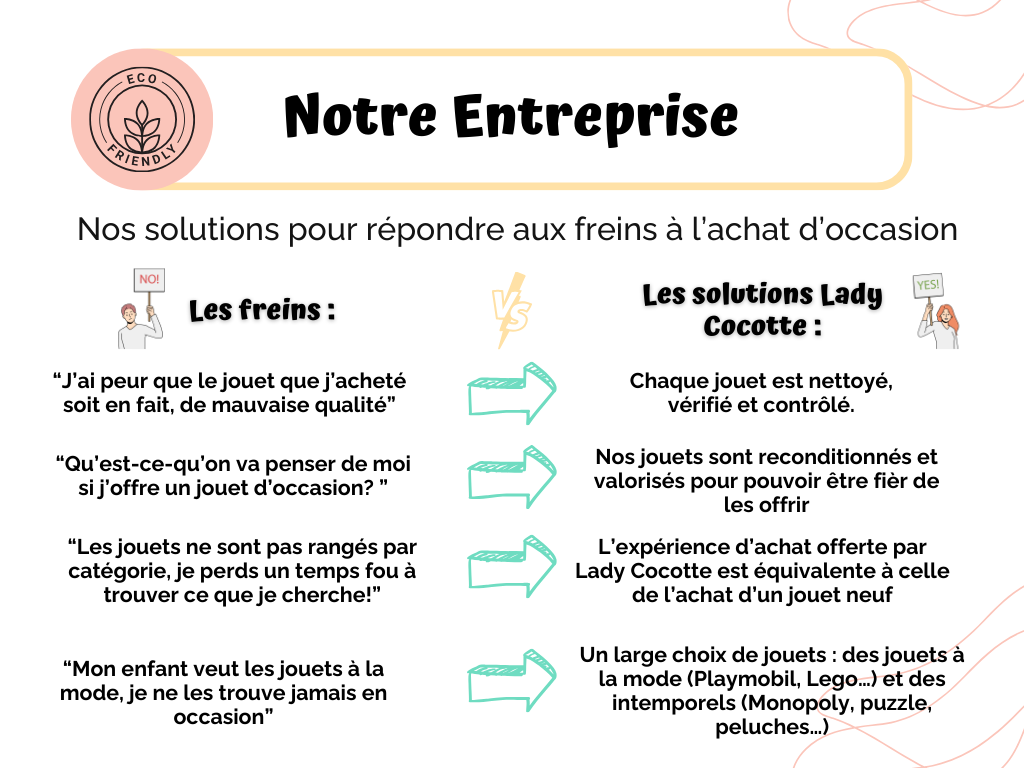

Le principal risque est le sourcing. Les clients et la demande sont là, mais il faut assez de ressources pour pouvoir s'approvisionner suffisament.

No.B.: over time, new risks may emerge and those presented may evolve.

To receive our detailed business plan, contact us at contact@ladycocotte.fr

Statistics

The project evaluation and investment statistics

/ Comments /

Register Connexion